When I started thinking about retirement, I quickly realized that my financial planning included a key component: supplemental income. But I hadn’t created a business online nor anything else for that, nor did I have a plan for extra retirement income. Sound familiar?

Many of us create our retirement plans when we are young, healthy, and confident. We make it to sixty and pull out our game plan for retirement only to find that it includes an additional $1000, monthly income to retire. Where is this going to come from?

What are our options? We are no longer talking about padding our nest egg, it is about creating a supplemental retirement income to keep our lifestyle intact. Where can we create a supplemental income and still stay engaged with the world? Keeping my mind sharp is also appealing. What better way to do this than by tapping into the prospects of the digital world?

Starting an online business can offer a wealth of opportunities for retirees. It’s not just a means to enhance income; it’s a doorway to engagement and personal growth. Who doesn’t like to learn about technology?

The benefits of being digital? They are substantial. We’re talking about flexibility to work from anywhere, the freedom to set your schedule, and a chance to capitalize on a lifetime of skills and interests.

Before diving into the ‘how,’ it’s important for retirees, and everyone looking to retire, like me, to consider our existing skills and how they translate into the digital market. What was your #1 accomplishment? No matter how small or how large, what gives you the most pride looking back on your life? We will craft that experience into your online income.

Whether it’s through consultancy, online tutoring, or content creation, there’s a slice of the digital pie for everyone. And let’s not forget about the various business models that align well with our more flexible schedules.

This phase of life brings a set of unique advantages to the online business table. A rich tapestry of professional experience, patience, and perhaps most importantly, the wisdom that comes with it.

Leveraging these traits in an online setting not only creates a potential stream of income but also provides a sense of purpose and connection in what’s often coined as the ‘golden years.’

It naturally follows that focusing on specific skills and interests leads to considering particular types of online businesses.

Niche blogging stands out as a particularly compelling option. It allows retirees to turn passions and expertise into a structured platform with passive income.

I am all about niche blogging for retirement income. We are not looking to create online empires, though it is possible. We are looking to create that extra $1000/month that we planned for.

The Power of Niche Blogging for Retirement Success

If I’m going to talk to you about starting an online business, I need to put niche blogging front and center. A niche blog zeroes in on a specific topic or audience. It’s like finding your corner of the internet where you can be the go-to expert.

The Golden Opportunity

So, why is niche blogging a golden opportunity for retirees? It’s simple. We have garnered a wealth of knowledge over the years, and there’s likely an audience searching for our insight. I am imparting mine through these very pages. Thirty years of accumulated know-how wrapped into Setting Points.

From soul-searching for your niche, researching the best entrance to success, leveraging AI to keep you on track, and creating a great blog. The extra $1000 a month is possible through Affiliate Marketing. I have used the Wealthy Affiliate training program to get to where I am today. Within six months, I earned the #1 Position for Niche Blogging for Retirement among many others.

Together, convert your knowledge into a niche blog that not only supports others, it can also bolster your retirement income.

Identifying a profitable niche starts with marrying your passions and experiences with what people are searching for.

Research keywords, scout out potential competitors, and listen to what your intended audience is discussing online. This ensures you select a niche you’ll love writing about and one that has an eager audience waiting. There are thousands of blogs starting every month. Google notes that 95% of all blogs will fail.

Following my lead, yours will not be one of them. When you’ve chosen that perfect niche, the next steps are to start your blog and begin creating killer content.

I’m talking about setting up a website, through Wealthy Affiliate, which is easier than ever, and generating articles, videos, or even podcasts that speak to your niche audience. Have you seen the update?

The trick is to start with one monetization strategy and expand as you grow. Before you know it, your blog can become a significant contributor to your retirement income, thanks to the power of passive earnings.

Smart Choices Will Create a Comfortable Retirement

I understand the challenge. You are starting with nothing and afraid that you won’t get there. So you do nothing. That is still a choice. Not a good one, but doing nothing is a choice.

Here is another option. Consider an online business to supplement your retirement. I took the leap of faith. Google has rewarded my efforts with the front page. If I can do it, I know that you can. But you might be asking yourself…

What is the Best Business for Me?

It is a vital question, and the answer to this lies in a blend of personal interest, market demand, and the kind of commitment you’re ready to make. If your future is in doubt do you have what it takes to do something about it?

Here are three great online options for earning retirement income.

E-Commerce – This is a popular choice. It’s adaptable and scalable, and you can run it from anywhere. However, it demands inventory management, customer service, and marketing skills. If you have a background in sales or customer relations, you might find this a natural fit. This is quite naturally FBA, Dropshipping, and selling on Etsy, Amazon, and eBay.

Consulting Services – This is another option, drawing on decades of experience in a specific field. The internet allows you to consult for clients globally, often with flexible hours. Online consulting marketplaces can be a great source of new opportunities for consultants. Platforms like Catalant, Expert360, and MeasureMatch connect consultants with clients seeking specific expertise. However, it’s important not to rely solely on these marketplaces for long-term business growth. Use these to grow your brand and branch out.

Digital Products—Think e-books, online courses, or webinars. These require time to create but then can be sold repeatedly without restocking inventory. This suits those with a passion for teaching or content creation. Canva is a popular place for creating content like my Bloggers Checklist.

Remember, the goal is to align your new venture with your lifestyle, interests, and retirement goals. Do not give in to chasing the money. You will never win simply doing this for the money.

Take the time to learn from others who have succeeded in their online endeavors. Seek out case studies, and success stories. Join online communities like Wealthy Affiliate, and never be afraid to ask for advice.

As you consider these options, reflect on how your skills might translate into a profitable and enjoyable online business.

A well-thought-out choice here sets you on a path toward achieving that all-important financial cushion in retirement.

Targeting the $1,000 Monthly Milestone in Retirement

I understand the importance of a clear financial goal. Setting sights on a supplementary monthly income, like $1,000, offers a tangible target for retirees starting an online business.

Monetizing a blog can take many forms, from displaying ads for high-traffic websites to affiliate marketing to selling e-books or courses. We have our goal of $1000/month, broken down to $250/week, or roughly $35/day.

Do the Math

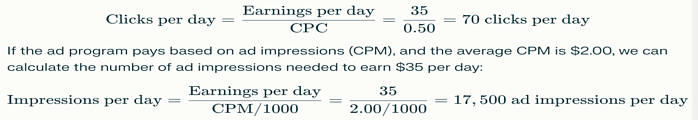

Google AdSense and Media.net are popular ad programs for displaying ads on blogs and earning revenue through clicks or ad impressions.

These calculations provide an estimate of the traffic needed to achieve the earnings goal based on the assumed CPC or CPM. The actual earnings and traffic requirements may vary based on the ad program, the blog’s niche, and the audience’s engagement. To achieve our goals, we need to be able to see what we need and how to get there.

Here’s a guide to help you reach that figure by combining strategic planning with actionable steps.

Revenue streams are as diverse as the online market itself. Affiliate marketing, where you earn a commission for promoting other people’s products, is a prime example.

Then, there are digital products such as e-books or online courses, which, after the initial effort in creating them, can sell repeatedly without much additional work.

Consulting Services, leveraging your years of professional experience, can command a handsome hourly fee.

You need to balance your initial investment, the time you have available, and the effort required. This balance is crucial because over-investing in one area can lead to burnout or a depleted savings account.

Simplicity is key. Focus on one or two streams initially and expand as you grow.

As you make your foray into this endeavor, keep a vigilant eye on the numbers. Use accounting software or simple spreadsheets to track your income and expenses.

If a particular revenue stream isn’t bearing fruit after a fair trial, reassess and adjust your approach. Be patient but persistent and remember that businesses take time to grow.

Remember, I emphasized the notion of aligning your skills with your business choice. If you have been honest here, your investment of time will provide the income that you require. But is it too late?

Age is Just a Number

Starting a Business at 65 and Beyond

While some people might feel uncertain about starting a business at 65 or older, I’m here to tell you that your years can be one of your greatest assets. The idea that entrepreneurship is solely a young person’s game is a myth thoroughly debunked by countless success stories. Real-world examples showcase individuals leveraging their life’s wisdom into successful business ventures, proving that experience counts.

Age Should Never Be a Deterrent

Quite the opposite; it’s a competitive edge in the business world. With more life experience, you have a unique perspective, a wealth of knowledge, and a vast network, all of which are invaluable when starting an online business. These are qualities that can’t be fast-tracked and they often lead to more thoughtful, customer-centric services and products.

Furthermore, consider the practical advantages you hold. A better understanding of your target market if they share your demographic, possibly more financial stability to invest in your business startup, and what’s more, an opportunity to transform a lifelong passion or hobby into a profitable venture. With proper planning and strategic action, age can be the catalyst, not the barrier, to a successful online business.

Let me make it clear – Starting a business at any age requires thought, planning, and a willingness to learn and adapt. At 65 or older, you’re in a unique position to do just that. Draw from your rich history of experiences to build an enterprise that not only complements your retirement but also brings you joy and fulfillment in this exciting chapter of your life.

If you’re contemplating launching an online business as a retiree, I encourage you to recognize the strengths your years bring. Don’t just take my word for it; even though Setting Points is succeeding, look to the many other successful entrepreneurs who have flourished later in life.

Ray Kroc: Kroc spent his career as a milkshake-device salesman before buying McDonald’s at age 52 in 1954. He grew it into the world’s biggest fast-food franchise.

Harland Sanders: Harland Sanders, the founder of Kentucky Fried Chicken (KFC), found success later in life. He franchised KFC at the age of 62, and the company became a global phenomenon.

Laura Ingalls Wilder: Laura Ingalls Wilder, the author of the “Little House on the Prairie” book series, published her first book at the age of 65. Her books became children’s literary classics and the basis for the popular TV show

Remember, in business, wisdom never ages, and it’s never too late to add a new title to your story: entrepreneur.

Don’t wait another day to build your financial cushion. Enroll in Wealthy Affiliate’s training program and unlock the secrets to a successful online business for retirees.