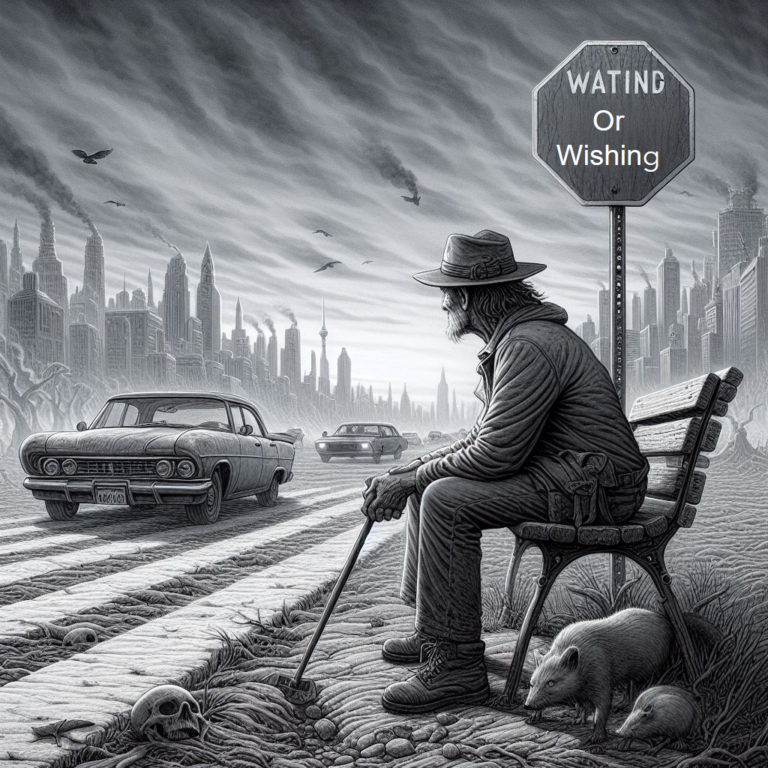

I hear it often, the ticking clock in the back of people’s minds as they discuss their predicament. Time waits for no one as the pages of the calendar are flipped up. What does your retirement look like? Are you at the Golden Gates of Retirement, with rest and enjoyment in your future? Unfortunately, nearly 80% of Americans today have a blurred vision of retirement. The extreme level of inflation is cracking our sacred nest egg. The Gray Apocalypse paints a stark picture of what awaits the unprepared. A landscape where the dreams of tranquil golden years have grayed into stress over financial security.

This isn’t fear-mongering. This is a reality that is knocking on the door of millions who find themselves wondering if they have what it takes to retire comfortably. My aim here is direct and clear. It is to inform you about this Retirement Savings Crisis and, more importantly, to empower you with solutions and strategies to face it head-on.

To Learn More When I’m 65

In this post, I will explore the ticking time bomb of underfunded retirements and what it means for our futures. The Gray Apocalypse isn’t an end-of-day scenario, but a wake-up call challenging us to take action NOW before the hourglass runs out.

So, let’s cut to the chase and understand what we’re up against, and then pivot to a practical measure you can take to avoid getting caught in this impending crisis.

Unveiling the Retirement Insecurity – The Graying Tide

When I talk about retirement insecurity, I’m referring to the growing concern that many individuals won’t have enough funds to maintain their standard of living once they stop working. Are you considering working until the very end?

The Gray Apocalypse is not just a buzzword that I created; it’s a tangible, pressing issue that touches the lives of millions. But what exactly constitutes the apocalypse’?

Let’s consider some numbers that put this into perspective.

- A report by the Economic Policy Institute revealed a stark disparity, with the median retirement savings of all working-age families being a meager $5,000.

- The National Institute on Retirement Security estimates that Americans have a retirement savings deficit of nearly $14 trillion.

- Forbes reported that the median retirement savings for all working-age households in the U.S. is around $95,776, which includes both employer-sponsored retirement accounts and individual retirement accounts

These figures are more than sobering; they should be a rallying cry for action.

If we don’t turn the tide, the consequences could be apocalyptic. A significant portion of the population already relies heavily on Social Security.

This is a system that wasn’t designed to be a sole income source and is facing its own challenges to sustainability. Dreams deferred. Decades of work, a retirement fund that’s a mirage.

Instead of golden years, worry takes root. The burden they never planned, becomes a shadow on their families’ joy. This is the harsh reality for too many retirees.

Recognizing the scale of this crisis is the first step in confronting and ultimately overcoming it. But awareness alone isn’t enough. I want to bring attention to the underlying factors of this retirement conundrum—because understanding ‘why’ paves the way for a ‘how’ to a solution.

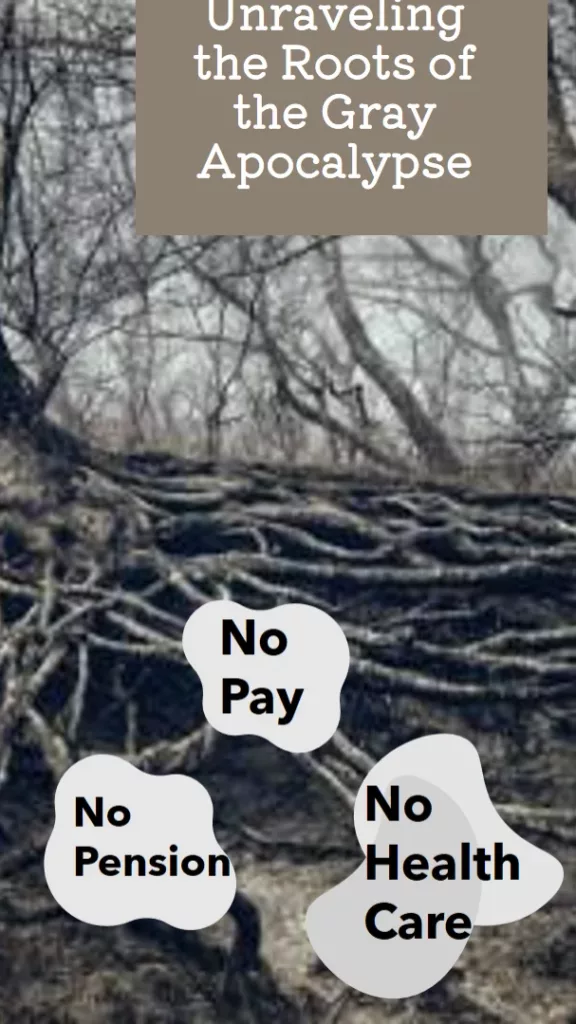

Unraveling the Roots of the Gray Apocalypse

Have you stopped to consider what’s fueling the crisis that darkens our retirement dreams?

Understanding the backdrop is vital. We’re not just talking about a random occurrence; a combination of factors has systematically led to the dire circumstances we face today.

- No Pension Funds – We must address the transforming employment landscape. It’s the leading factor creating the conditions for the perfect retirement crisis. The comforting pensions of lifelong employment is a relic of the past. Today’s frequent job transitions and the gig economy also complicate steady retirement contributions.

- Not Creating DC Plans – The transition from pension plans to Defined-Contribution (DC) Plans (401k) happened without fanfare. DC Plans are funded by the employee by deferring a portion of their gross salary to a retirement fund; employers can match the contributions up to a certain amount if they choose. Most people who are struggling to survive on their current wages, either suspend or do not start saving.

- Stagnant Wages – Regardless of the reason, the cost of living has skyrocketed. Your paycheck has not kept up. When was the last time you got a substantial raise It’s no wonder the gap between living expenses and savings is widening. The consequence is a further delay in saving for your retirement.

- Health Care Costs – Let’s not overlook the impact of rising healthcare costs. It’s a double-edged sword, as we live longer, we endure heftier medical bills. Often, these expenses come when earning potential has plummeted post-retirement.

- Student Loan Debt – We love our kids. We will do just about anything for them. As we continue to have children later in life, this debt is working its way into our retirement plans. The loan must be paid. For younger generations, they are entering their working lives with a financial ball and chain around their leg, delaying the start of their retirement preparation. This delay is compounded to never.

The Perfect Storm

These four major forces are chewing through your personal plan faster that you can contribute. Now you are asking yourself

“Am I saving enough to retire?” “If I zigged when I should’ve zagged financially, what are my options now?”

These are some of the Googled questions of ‘people who also ask’.

Sometimes we need examples to understand these broader economic trends. I find that personal stories hit home the hardest. Take Sarah, a teacher of 30 years, who is now grappling with the reality that her pension does not cover the cost of living due to unforeseen healthcare expenses. Does she eat or purchase the medicine that she requires?

Or consider Michael, a former factory worker whose company’s pension fund was depleted, forcing him into an unplanned semi-retirement filled with uncertainty and part-time jobs. The pension is gone. The only choice is to continue working until he can’t go any further.

These are not just anecdotes; they are stark reminders that the crisis is personal, and it’s unfolding in homes and communities across the country. The next section will explore the lifelines available, to not just cope, but potentially thrive in the face of the Retirement Savings Crisis.

Crafting Your Financial Ark to Weather the Storm

It’s easy to feel overwhelmed when facing the daunting waves of the retirement savings crisis. However, I have good news: with the right strategy, it’s possible to build a financial ark that will keep you afloat through this turbulence. The solutions are within your grasp, and I’ll guide you through the essential steps to secure your financial future.

Education – Financial literacy is POWERFUL. It gives you the confidence to make informed decisions and the knowledge to sidestep common pitfalls. Seek out books, online courses, and local seminars to bolster your financial understanding.

I know you may not have time to do the research. I’ve got you.

- Investopedia’s Best Resources for Improving Financial Literacy – This comprehensive guide provides a wide range of resources, including books, magazines, podcasts, and in-person community events to increase financial literacy. It also highlights the value of financial websites, such as Investopedia, as a powerful and convenient resource for learning about various financial topics

- OppU’s Free Financial Literacy Resources – This resource offers a list of free financial literacy resources, including online and in-person options. It covers apps, websites, and in-person classes and workshops, making it a valuable source for individuals seeking to improve their financial understanding on a budget.

These sources provide a wealth of information and options for financial literacy. Now that you have a better understanding of financial literacy, work to get your financial life in order.

Manage Debt – Limiting what you owe and creating a sensible budget is a great place to start. High-interest debt can be a sinkhole for your finances, so prioritize paying it down. Create a budget that allows for debt reduction, savings, and still enjoying life’s necessities and modest pleasures.

Know Your Goal – A smart move is to utilize retirement calculators and budgeting apps. NewRetirement has a great free retirement calculator. Their tools demystify the numbers and give you a clear picture of where you stand and what you need to do to reach your retirement goals.

Stop Procrastinating – It is on you to create your retirement. Companies are not going to give you anything. The government is going broke. Whether it’s a 401(k), IRA, or HSA, understand your contribution limits, tax advantages, and employer matching programs. Ensure you’re making the most of these opportunities. For instance, if your employer matches 401(k) contributions, aim to contribute enough to get the full match; it’s essentially free money.

Investment Strategy – It’s important to have a diversified portfolio aligned with your retirement timeline and risk tolerance. Lower-risk investments are typically recommended as you approach retirement, but if you’re starting late, you might need a more aggressive approach. Seeking advice from a financial advisor can be a game-changer in this area.

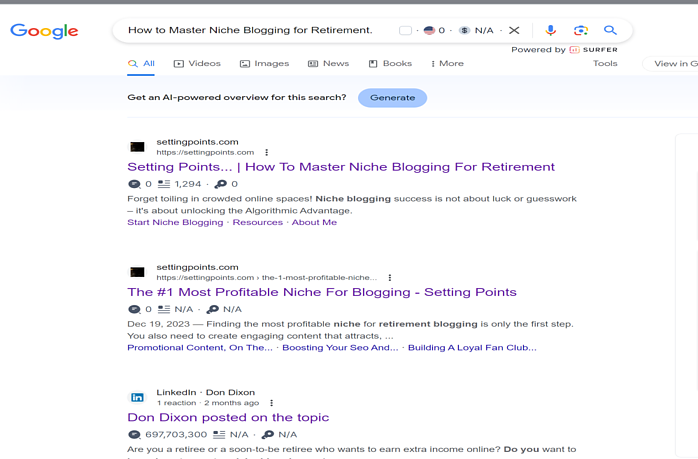

Supplement Your Income – Securing your retirement might involve additional streams of income. This could mean anything from a part-time job to passive income ventures like rental properties or side businesses. I have put my faith in niche blogging and affiliate marketing.

Setting Points is the #1 Blog for How to Master Niche Blogging for Retirement.

I was like you until I found Wealthy Affiliate. The investment that I made in myself, changed the course of my retirement. I started Setting Points on 4 June 2023. Today, six months later, I have 10 Posts in the first position on Google, and 15 in the first position on Yahoo! Fifty of Seventy-Five posts are indexed and listed on Google.

Don’t let financial anxieties bog you down; always remember, even small steps taken today will have a profound impact on your retirement. As you follow these guidelines, you will find security in your own financial ark. Setting Points is setting the stage for a brighter future for all of us.

Charting a Course to a Prosperous and Serene Retirement

It’s not just about surviving the storm; it’s about reaching calm waters and clear skies. The Gray Apocalypse doesn’t have to be in your future. With every step you take today, you are actively building a more secure tomorrow.

While the challenges can feel overwhelming, remember, preparation is POWER. When you make informed choices and foster discipline in your financial habits, you establish control over your retirement destiny.

Community and conversation play pivotal roles in this journey. When you talk about retirement savings, not only do you become more accountable, but you also spread awareness. Imagine the impact if everyone had the tools and knowledge to supplement their income for retirement. That is the mission of Setting Points.

Your actions today are like seeds planted in fertile soil, growing over time to provide stability and peace of mind for your later years. I encourage you to take your insights from this discussion and help others find their path—whether it’s family members, friends, or colleagues at work.

And, as we steer toward the horizon, let’s remember this: a brighter retirement is not just a distant dream; it’s an attainable reality. With each contribution to your retirement fund, with every debt you clear and every budget you trim, you’re not just saving money—you’re buying future happiness, freedom, and peace.

I’ll leave you with this thought: It’s in the power of our collective efforts that we can turn the tide on the Retirement Savings Crisis. Let’s commit to building a future where the Gray Apocalypse is just a myth—a narrative we changed together through foresight, planning, and a shared quest for financial well-being.

Stepping into Action is a Call to Secure Your Future

I’m not an alarmist by nature, but I see the writing on the wall. Waiting or wishing won’t ward off the Gray Apocalypse; action is the only antidote. My goal in sharing this information isn’t to scare you but to spur you into taking control of your financial destiny. The path to a secure retirement isn’t shrouded in mystery—it’s paved with the consistent steps you take today, tomorrow, and every day after.

Consider this your rallying cry to rise above the Retirement Savings Crisis. The tools and strategies discussed earlier are your starting blocks. Whether it’s downloading a retirement planning guide, attending a financial webinar, or setting up an appointment with a financial advisor, the key is to engage NOW.

Feel uncertain? That’s natural. But let those feelings serve as the catalyst for your journey, not the anchor that keeps you docked in the harbor of indecision. Reach out to experts, absorb knowledge, and turn that into action. Remember, knowledge isn’t just power—it’s empowerment.

And don’t stop with your own journey. Share this article with friends, family, or anyone who might benefit. Encourage conversations about retirement planning. The more informed we all are, the brighter the collective future becomes.

Today is the perfect day to take one small step closer to the retirement you deserve. Embrace the challenge, command your finances, and watch the Gray Apocalypse give way to your golden years, full of peace, prosperity, and well-earned relaxation.